How derivative traders can make the most of increased volatility

Por um escritor misterioso

Last updated 24 fevereiro 2025

It has become routine for Nifty to go up or down by 300 points —around 1,000 points on the Sensex—daily. Though heightened volatility unnerves normal investors, it spells opportunities for derivative traders.

Wall Street Dealers in Hedging Frenzy Get Blamed for Volatility

Calculus In The Stock Market

:max_bytes(150000):strip_icc()/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

Volatility From the Investor's Point of View

Implied Volatility, Basics, Factors & Importance

Volatility Modeling and Trading: Q&A with Euan Sinclair

The Importance of Liquidity and Volatility For Traders

Options Trading X, Vega distribution in relation to Volatility

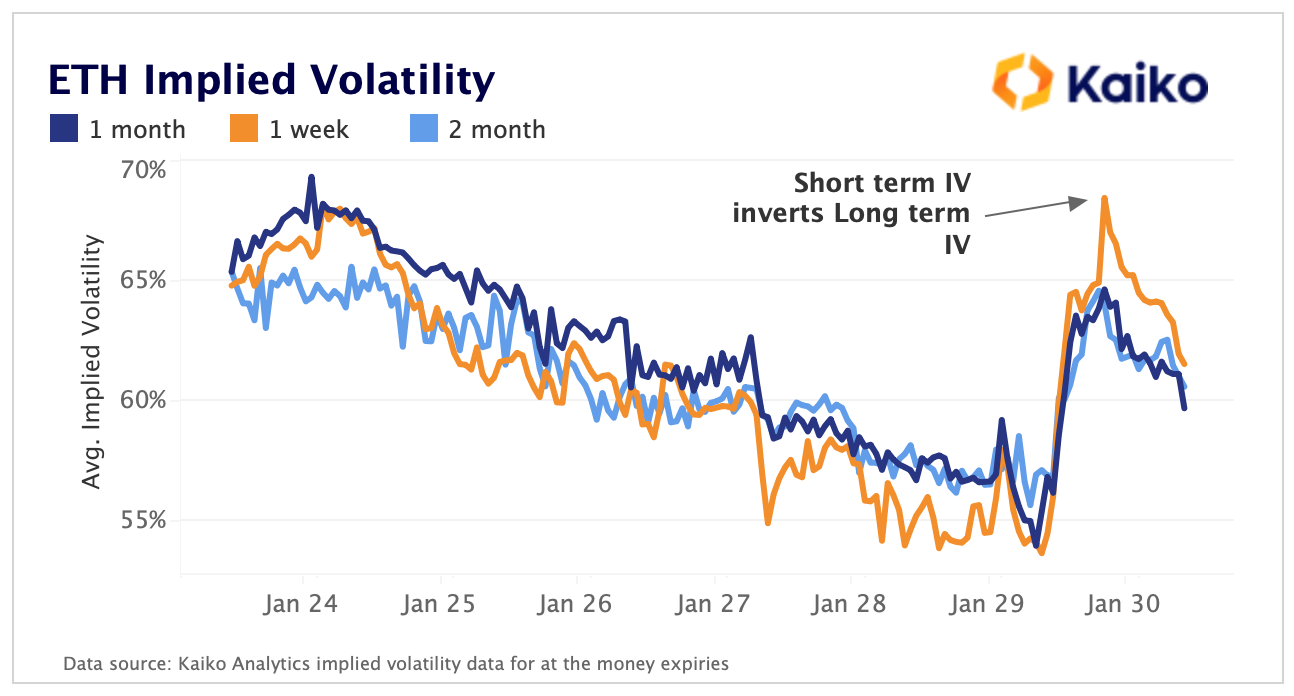

APT's Extraordinary Rally Examined, by Kaiko

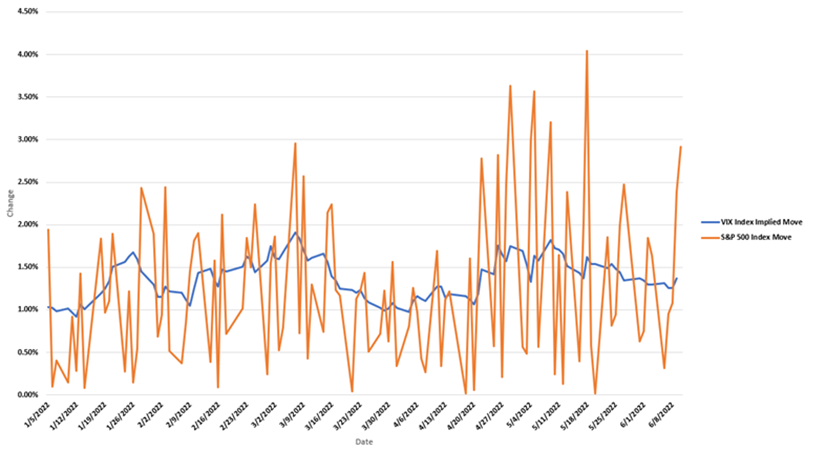

Volatility Insights: Evaluating the Market Impact of SPX 0DTE Options

Energy gets a test Active Trader Commentary

Inside Volatility Trading: Breaking Down the VIX Index and its

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PEHKXGHYGJIEBP4VYJEHRJE52Q.jpg)

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2023/f/6/uGDdb8Q86ImhtIaXNlHQ/xapa1.jpg)