Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 26 abril 2025

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

Guide to Taxes for Independent Contractors (2023)

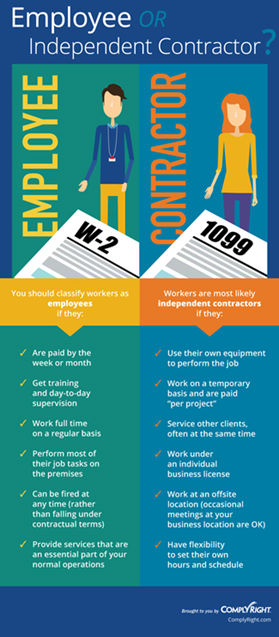

Employee misclassification penalties: Examples and protections

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How to Report and Pay Taxes on 1099-NEC Income

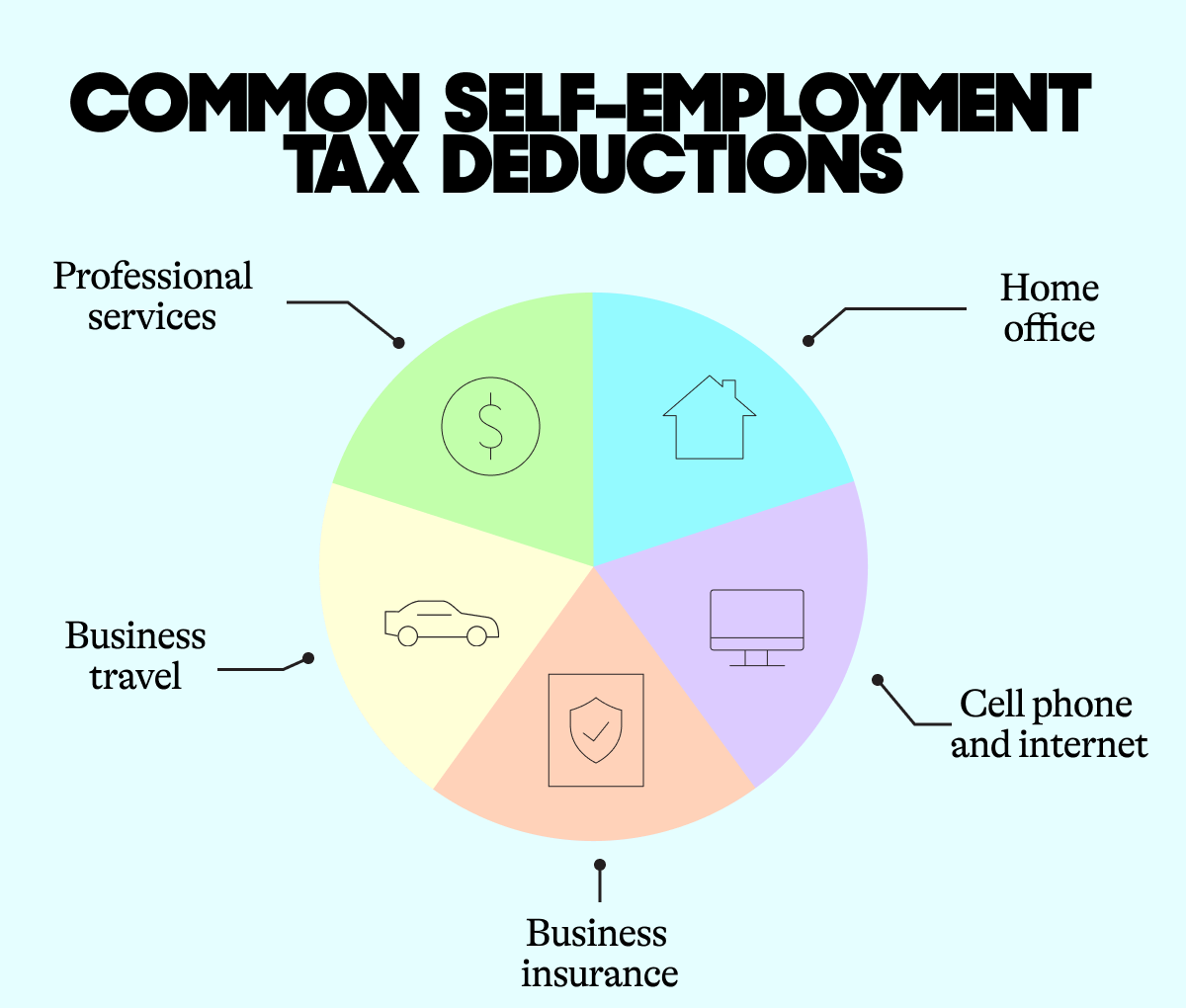

16 Amazing Tax Deductions for Independent Contractors In 2023

.png?width=3600&height=2025&name=Group%2031368%20(1).png)

8 Benefits Of Being An Independent Contractor in 2023

Free Independent Contractor Agreement Template

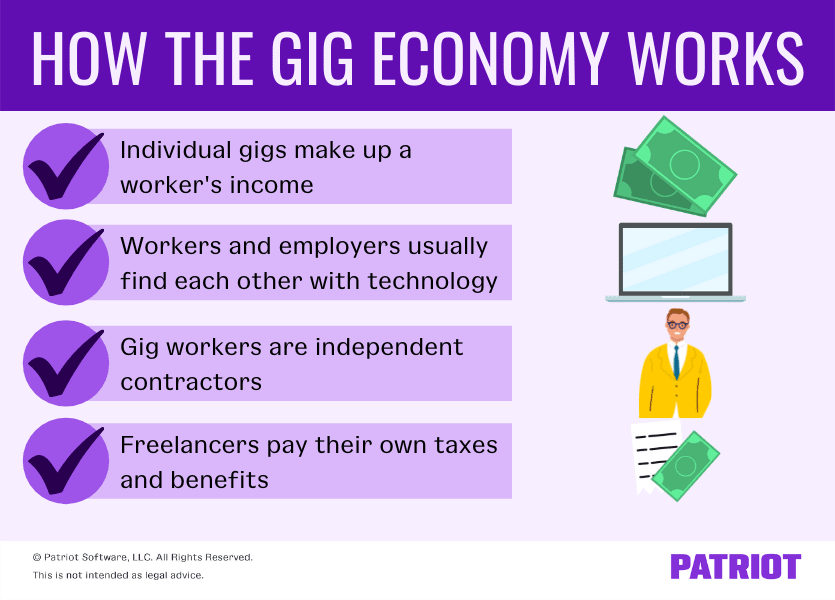

Gig Economy Who Are Gig Workers and What Is the Gig Economy?

What do the Expense entries on the Schedule C mean? – Support

What is an Independent Contractor? Are They Employees?

Guide to Independent Contractor Jobs: Gigs and Freelance Jobs

:max_bytes(150000):strip_icc()/IRS1099-NEC-d99c3a32d35849eebdfa321d90d023a8.jpg)

Form 1099-NEC: Nonemployee Compensation

An Independent Contractor's Guide to Taxes - SmartAsset

A Guide to Independent Contractor Taxes - Ramsey

The Independent Contractor Tax Rate: Breaking It Down • Benzinga

![Level 700] Easy Guide Second Sea and Kill Ice Admiral - Blox](https://i.ytimg.com/vi/PfBymwWYntA/sddefault.jpg)

![3.17.0] Subway Surfers Apk Mod Dinheiro Infinito Versão Atualizado](https://i.ytimg.com/vi/GLtwvHUWo_s/maxresdefault.jpg)